- 60 16260 8323

- info@smifunding.my

Experienced In Consult & Business Advice!

Gone are the days when users were paying hefty fees to mobile service providers to send text messages. Users today require unlimited free texts.

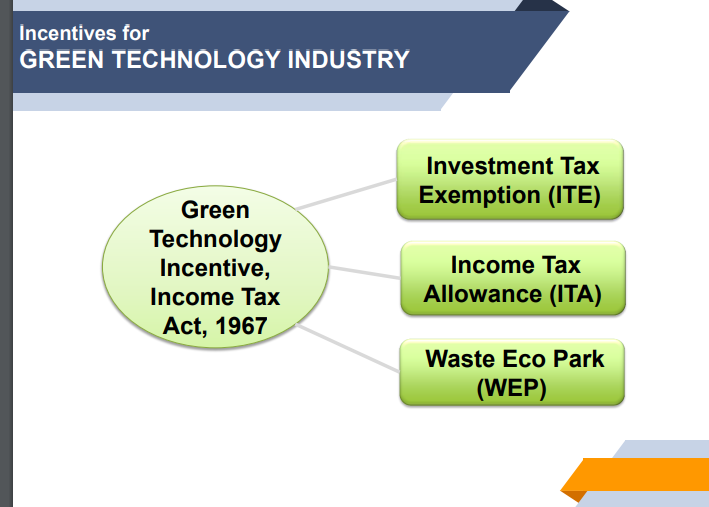

Incentives for GREEN TECHNOLOGY INDUSTRY

Green Technology Incentive, Income Tax Act, 1967

-

Investment Tax Exemption (ITE)

-

Income Tax Allowance (ITA)

-

Waste Eco Park (WEP)

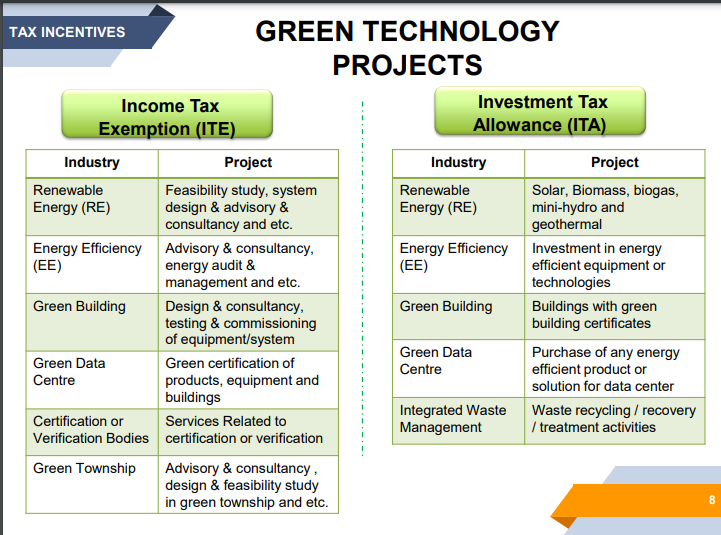

Two categories of tax incentives available for companies involved in green technology projects in Malaysia: Income Tax Exemption (ITE) and Investment Tax Allowance (ITA)

1. Income Tax Exemption (ITE)

This incentive applies to companies undertaking specific projects across various industries. Eligible projects include:

Renewable Energy (RE): Feasibility studies, system design, and consultancy services.

Energy Efficiency (EE): Advisory, consultancy, energy audits, and management.

Green Building: Design and consultancy, testing, and commissioning of equipment or systems.

Green Data Centre: Certification of products, equipment, and buildings for green standards.

Certification/Verification Bodies: Services related to certification or verification.

Green Township: Advisory, consultancy, and feasibility studies for green township projects.

2. Investment Tax Allowance (ITA)

This incentive supports companies investing in capital expenditure for green-related projects. Examples include:

Renewable Energy (RE): Investments in solar, biomass, biogas, mini-hydro, and geothermal energy projects.

Energy Efficiency (EE): Purchase of energy-efficient equipment or adoption of energy-saving technologies.

Green Building: Construction of buildings certified with green building standards.

Green Data Centre: Investment in energy-efficient products or solutions for data centers.

Integrated Waste Management: Projects involving recycling, recovery, or treatment of waste.

Research & Development (R&D) tax incentives in Malaysia

You may choose one of these incentives:

Pioneer Status (PS): 100% income tax exemption on statutory income for 5 years; or

Investment Tax Allowance (ITA): 100% of qualifying capital expenditure for 10 years, usable to offset up to 70% of statutory income each year.

Only unrelated client companies can claim a double deduction on the payments they make to the R&D service company.

In-house R&D (you do R&D within your own company for your own business)

You can get an Investment Tax Allowance (ITA) of 50% of qualifying capital expenditure for 10 years.

That ITA can be used to offset up to 70% of statutory income each year.

SMI FUNDING provides financial support to help accelerate business recovery and drive growth for our clients

Who are we

- About

- Our Location

- Services

Contact Us

D-17-26 Menara Mutiara Central No 2, Jalan Desa Aman 1, 56100 Kuala Lumpur, Malaysia.

60 16260 8323

Info@SMIFunding.my

Copyright 2025, www.smifunding.my. All Rights Reserved.